Crafting a seamless onboarding experience

Libro Credit Union - Online Banking

End to End Product Design . Design System . Brand Identity . Design Strategy

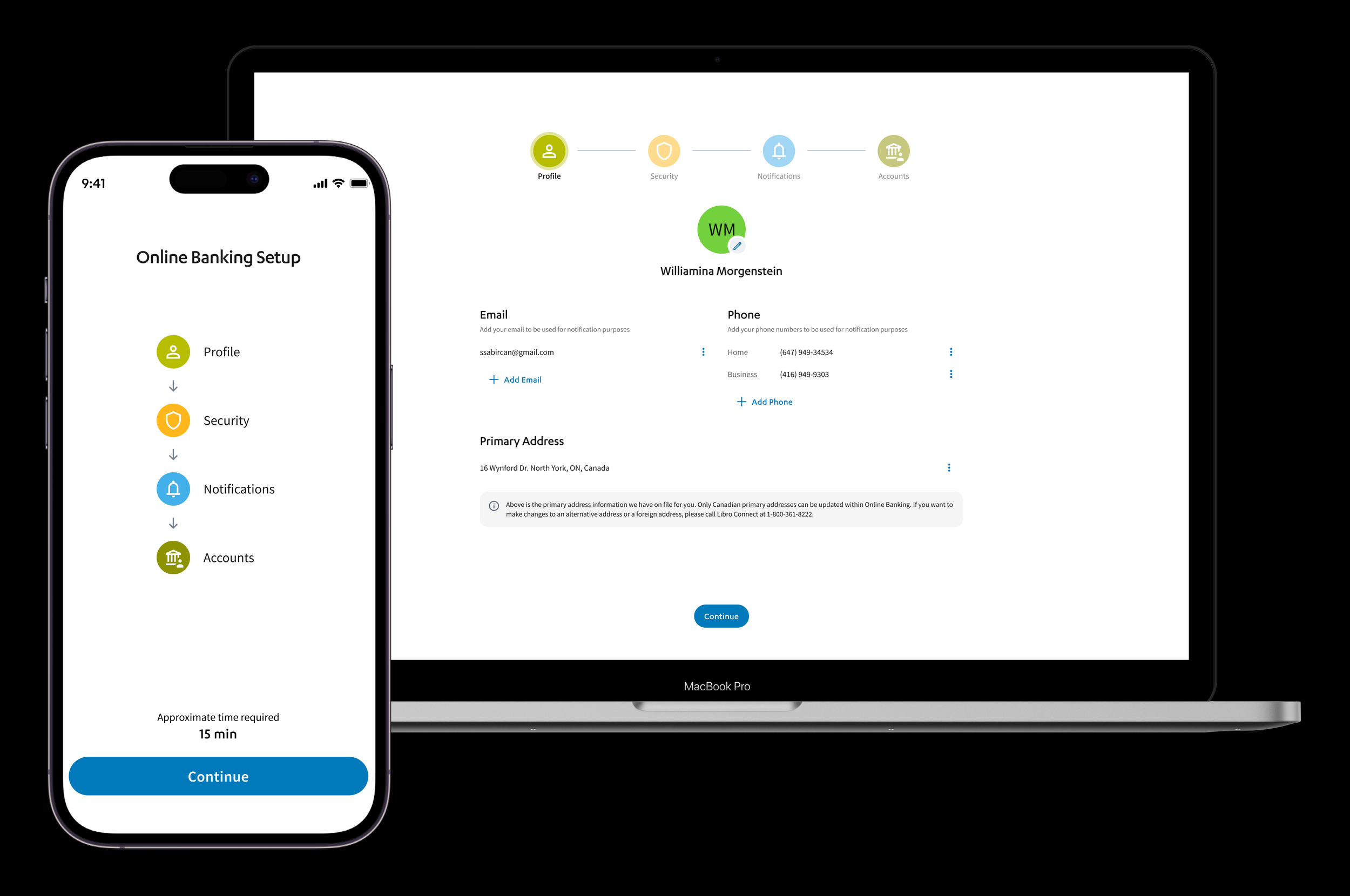

Libro’s onboarding experience is a critical first touchpoint for new Owners joining the credit union. As the sole UX designer on the project, I was responsible for redesigning the onboarding journey.

Methods:

Market research, user interviews, current journey analysis, ideation, icon and component design, wireframing and prototyping, usability testing

My Role:

UX Designer and Researcher

Goal:

The project aimed to revamp the onboarding experience for Libro Owners (users) to create a more inclusive, consistent, and user-friendly experience that aligns with Libro’s values and reinforces its commitment to Owner-first banking.

Duration:

3 months (6 sprints)

Team:

Cross-functional agile team - 3 developers, a BA, a QA, a product owner, a scrum master, and a UX designer (me)

Tools:

Figma, Miro, DevOps, Lyssna

A Look Into the Data

RESEARCH

Market Research Findings

Research into customer expectations and current digital banking trends uncovered essential insights to guide improvements in Libro’s onboarding experience.

🙋♀️ Customer Expectations

-

72% of users prefer setting up security credentials first, building early trust.

-

Users are 45% more likely to abandon tasks when faced with long, scroll-heavy pages. Breaking content into sections with clear navigation improves engagement.

-

57% of users abandon onboarding if it takes longer than 10 minutes, highlighting the need for a streamlined process.

-

Progress indicators and tooltips reduce friction and keep users engaged.

-

68% of banking users prefer in-context help features over FAQs or external guides.

🖥️ Digital Banking Trend

-

75% of users access accounts on both desktop and mobile, with 60% expecting identical. workflows.

-

RBC, Scotiabank, and fintech challengers like Tangerine and WealthSimple use AI for guidance, personalization, and self-serve options.

-

Features like account recommendations, guided setup tours, and interactive tutorials enhance the experience.

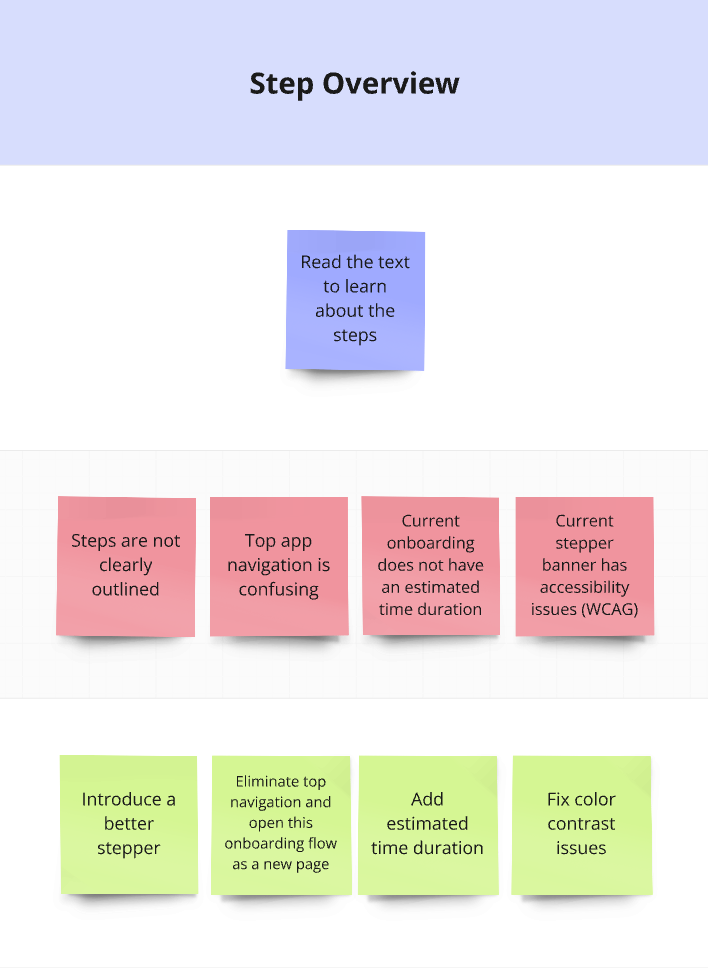

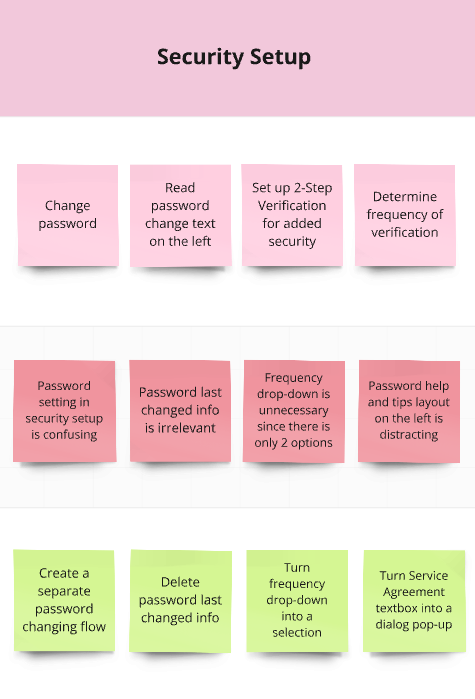

Current User Journey

Taking a closer look at the existing Libro online banking onboarding experience to gain a clearer understanding of the core issues.

Workflow

Mapping the user flow of the onboarding experience for a clear visual of the current process, helping identify inefficiencies and informing future enhancement opportunities.

🧐 Heuristic Evaluation

A heuristic evaluation identified 20 critical barriers in the existing onboarding flow, highlighting areas where the experience failed to meet inclusive design standards.

🚩 Pain Points from the User Interviews

I conducted 10 user interviews, and the key pain points identified closely aligned with the issues uncovered in the heuristic evaluation.

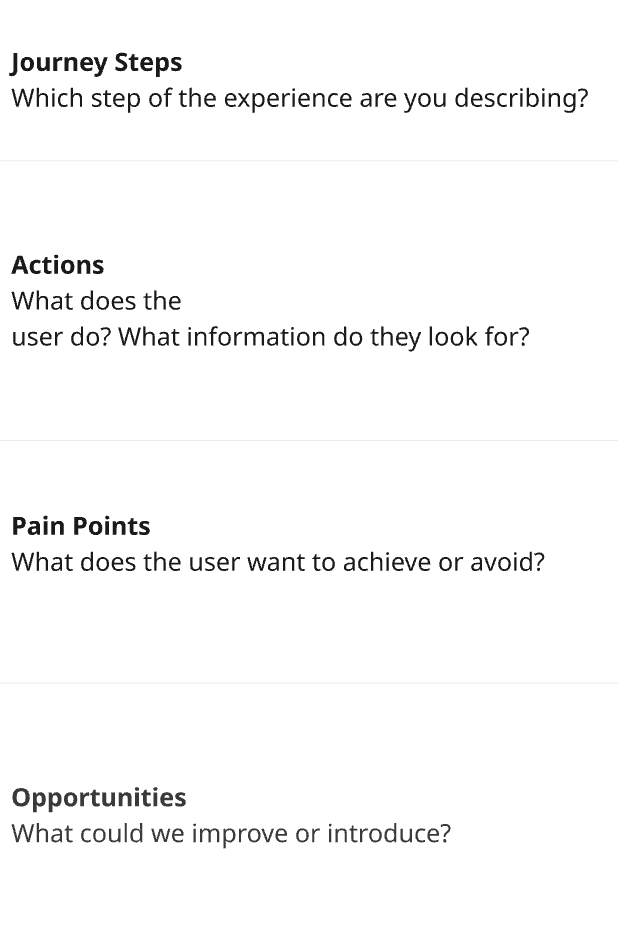

The research findings were synthesized into a journey map that clearly highlights steps, user actions, key pain points, and opportunities for improvement.

Journey Map

Sticky Notes to Solutions

IDEATION

💡 Ideation Sessions

I led a series of ideation sessions to explore solutions for enhancing the onboarding experience. The goal was to generate a wide range of ideas from grounded improvements to bold, future-thinking concepts.

I structured the ideation process into four targeted sessions to gather diverse perspectives across the organization.

🎯 Session 1: Onboarding Team

"Fix the Friction"

Focus: Identify improvements to the step-by-step flow and content clarity.

Participants: Coaches and staff involved in onboarding new Owners.

Activity: Crazy 8s and “How Might We” prompts based on pain points from the journey map.

👥 Session 3: Stakeholders

"Business Goals & Owner Impact"

Focus: Align onboarding with business priorities while improving Owner satisfaction.

Participants: Product owners, compliance, marketing, and business banking leads.

Activity: Impact/Effort Matrix based on business metrics and Owner outcomes.

🙋♀️ Session 4: Solo Ideation

"Stretch the Boundaries"

Focus: Explore bold or unconventional ideas unconstrained by current platform or policies.

Activity: Lightning Demos from competitor apps followed by 15-minute sketch storm.

💻 Session 2: Digital Team

"Consistency & Scalability"

Focus: Ensure visual and functional consistency across devices and platforms.

Participants: Developers, QA, and product managers from the Digital team.

Activity: Brainwriting and flowchart critique with post-its based on mobile/desktop friction.

💬 Outcomes

These sessions provided a rich set of ideas that were voted on based (marked with circles) on feasibility, impact, and alignment with project goals. Several of the low-to-mid effort ideas such as restructured step indicators, contextual help, and mobile-optimized layouts were incorporated into the final onboarding design.

The bolder concepts helped shape a long-term vision for future enhancement projects.

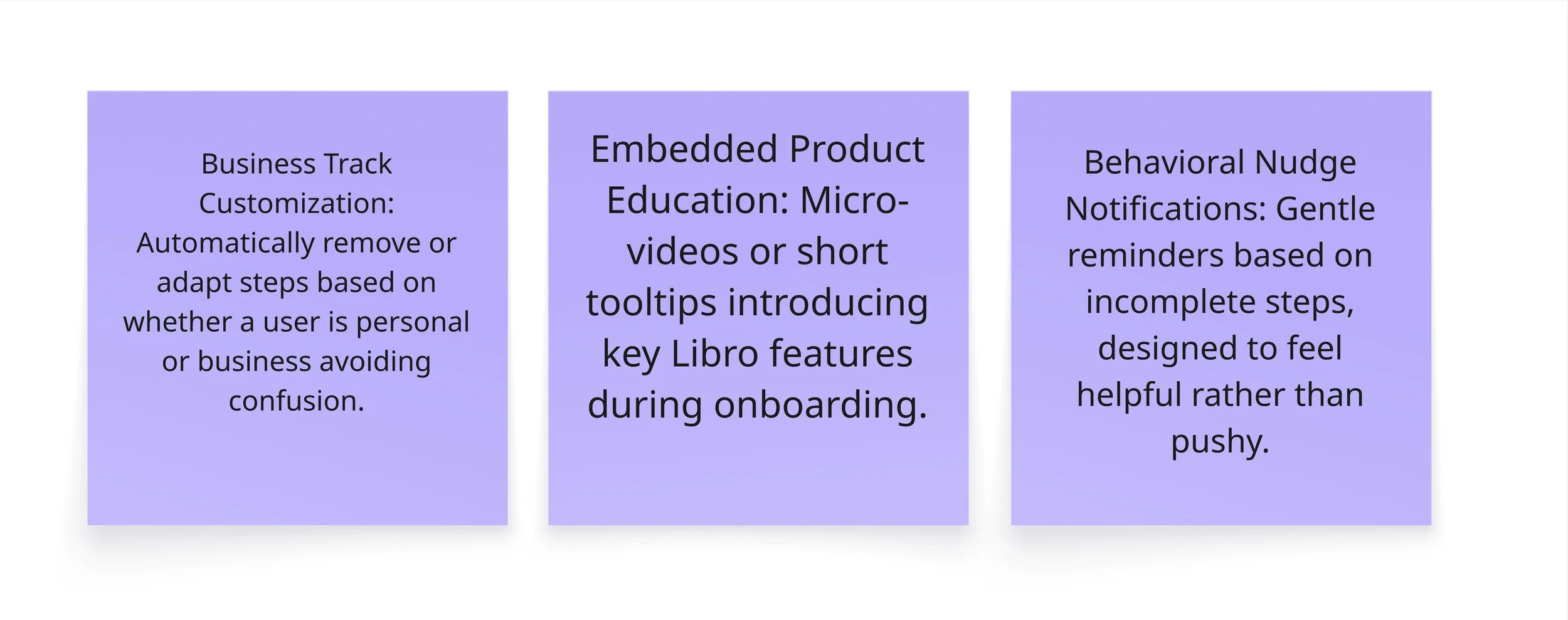

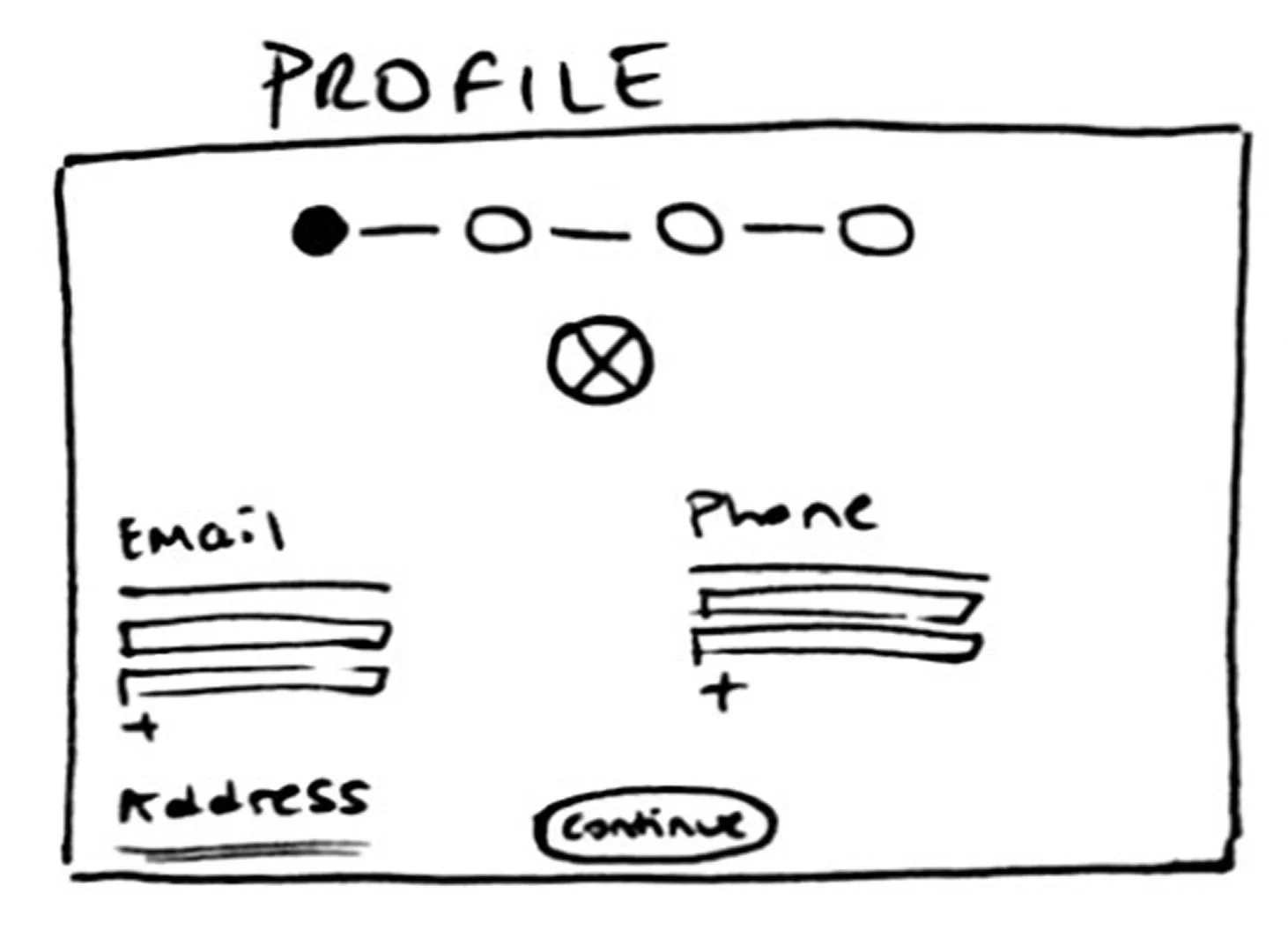

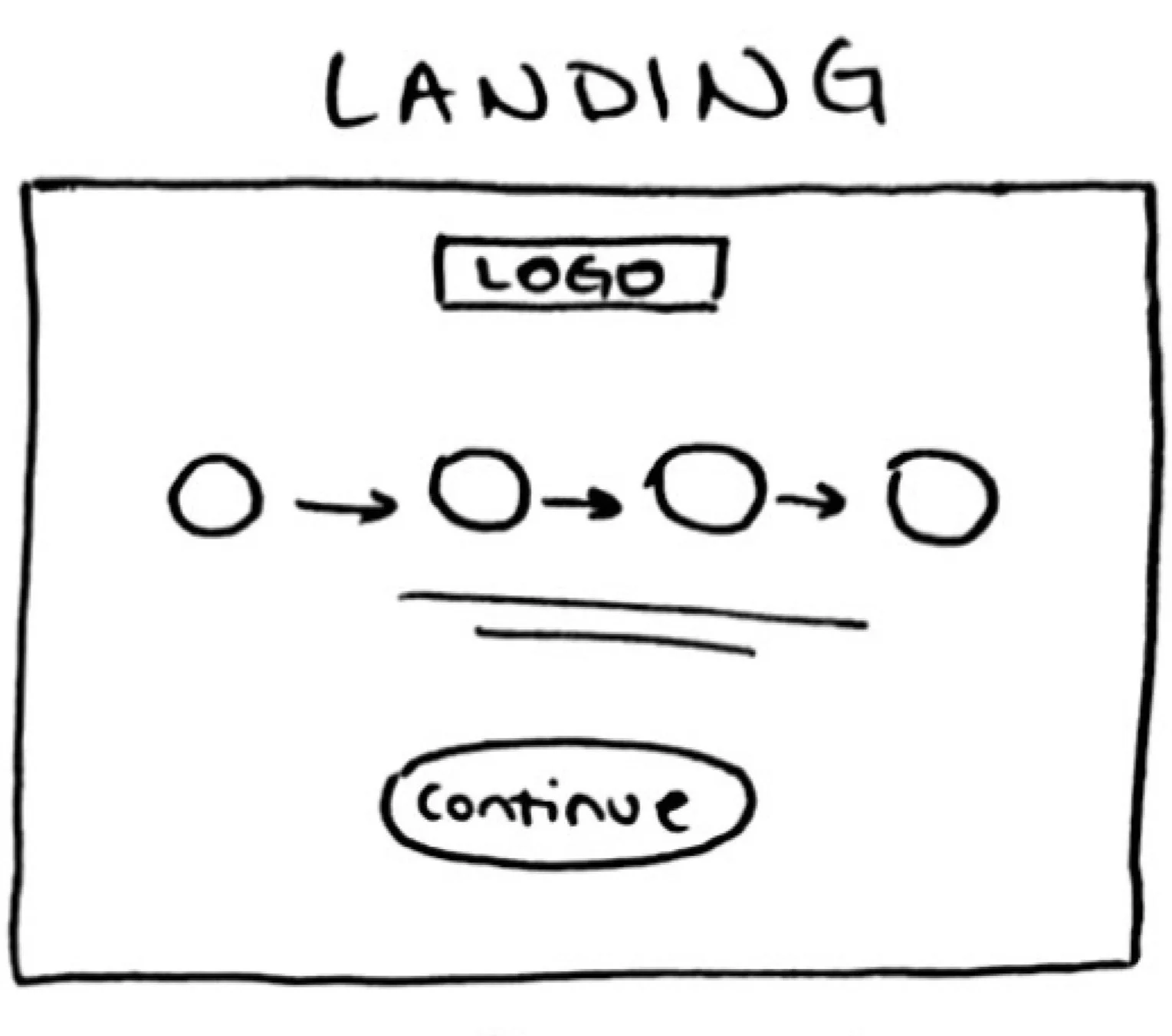

🖊️ Visualizing the ideas

I began by creating low-fidelity sketches to quickly visualize early concepts. I like working in low fidelity because it allows rapid iteration without getting caught up in visual details, enabling focus on structure and user flow before committing to final UI elements.

✔️ Service Agreement in the beginning to improve logical flow

✔️ Two-step acceptance (checkbox + button) to reduce unintentional consent

✔️ Big pop-up window to improve readability and ensure accessibility

✔️ Opacity in the stepper to indicate pending steps

✔️ Profile image edit option to support easy personalization

✔️ Email and phone fields placed side by side to improve layout efficiency

✔️Address disclaimer banner to increase compliance clarity

✔️ Help icon to provide quick, accessible support

✔️ Pop-up alignment to improve readability of contact method modals

✔️ Disabled button to prevent user confusion when actions are incomplete

✔️ Tabs to divide complex information into digestible sections

✔️ Collapsible drawer for accounts to reduce clutter

✔️ "Same for all accounts" checkbox to reduce repetitive input

✔️Sticky continue button to improve task flow

✔️ Split-screen design to enhance branding visibility and improve layout balance

✔️ Progressive disclosure for entering Owner number and password to simplify the UX

✔️ A prominent Libro branch image on the left to reinforce brand identity

✔️ Service Agreement in the beginning to improve logical flow

✔️ Two-step acceptance (checkbox + button) to reduce unintentional consent

✔️ Big pop-up window to improve readability and ensure accessibility

✔️ "Accounts" in the stepper to make the label more inclusive and intuitive

✔️ Visual stepper with icons to Improves scannability and user orientation

✔️ Center-aligned page to create better visual balance and hierarchy

✔️ Estimated time text to help manage user expectations

✔️ Opacity in the stepper to indicate pending steps

✔️ Profile image edit option to support easy personalization

✔️ Email and phone fields placed side by side to improve layout efficiency

✔️Address disclaimer banner to increase compliance clarity

Final Product

If you're having trouble viewing the embedded prototype, use the buttons below to access the high-fidelity Desktop and Mobile versions, along with any portfolio visuals referenced in this case study. A demo video of the final product is also available for a complete walkthrough.

Desktop Prototype

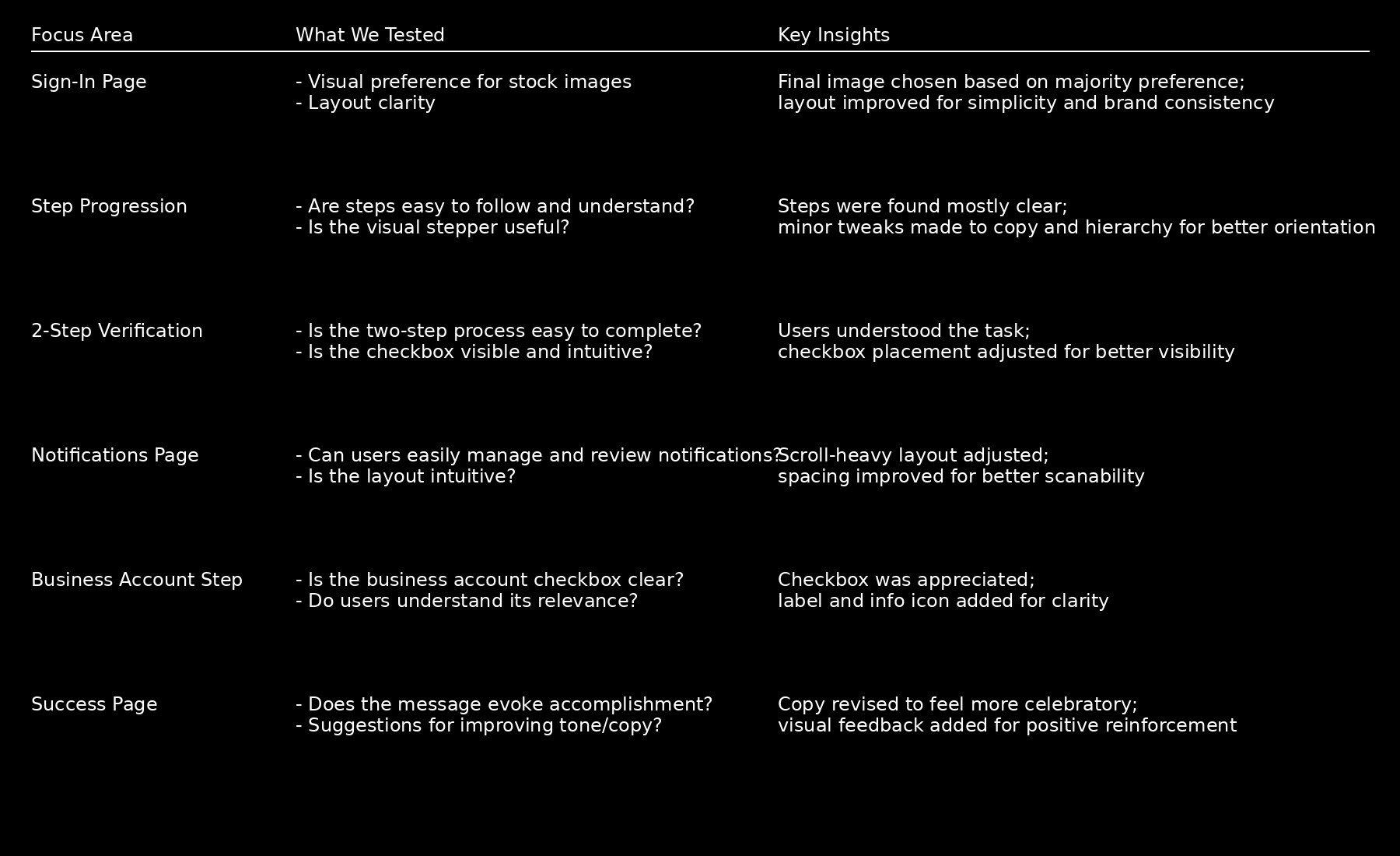

Putting It to the Test

Participants:

Internal Libro staff and selected Owners familiar with digital banking

Number of Tests Conducted:

3 rounds of usability testing

Total Iterations:

4 design iterations

6 development iterations

Tool Used:

Lyssna (formerly UsabilityHub)

Test Types:

Visual preference tests, click tests, and comprehension-based question prompts

Results Overview

😊 Satisfaction rate increased to 92%

⏱️ Average session length decreased to 7 minutes

✅ Completion rate increased to 86%

📞 In 2025, Libro Connect received only 20 calls related to online onboarding, All were related to temporary password resets.

Fidelity Tested:

Low to high-fidelity wireframes